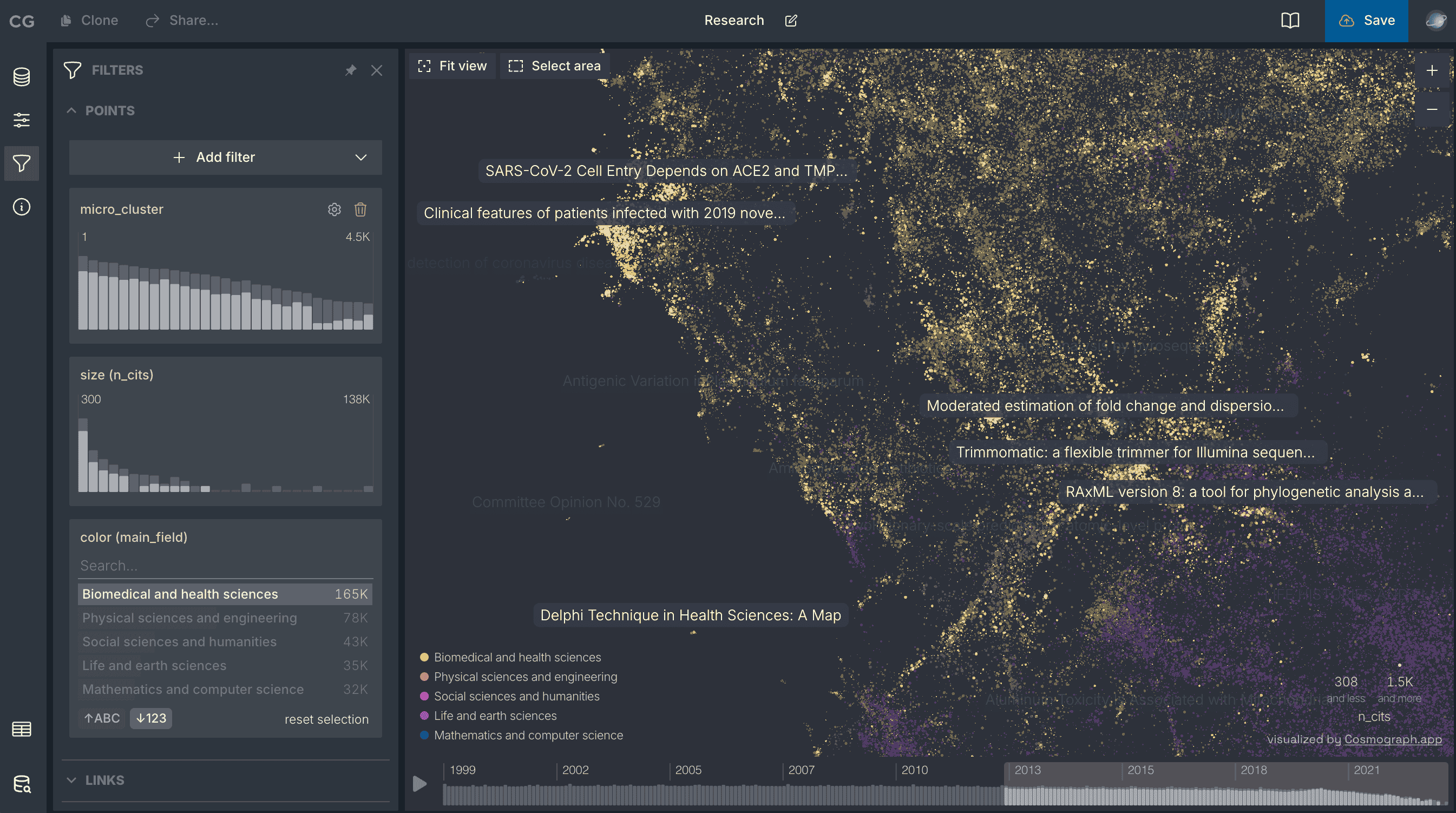

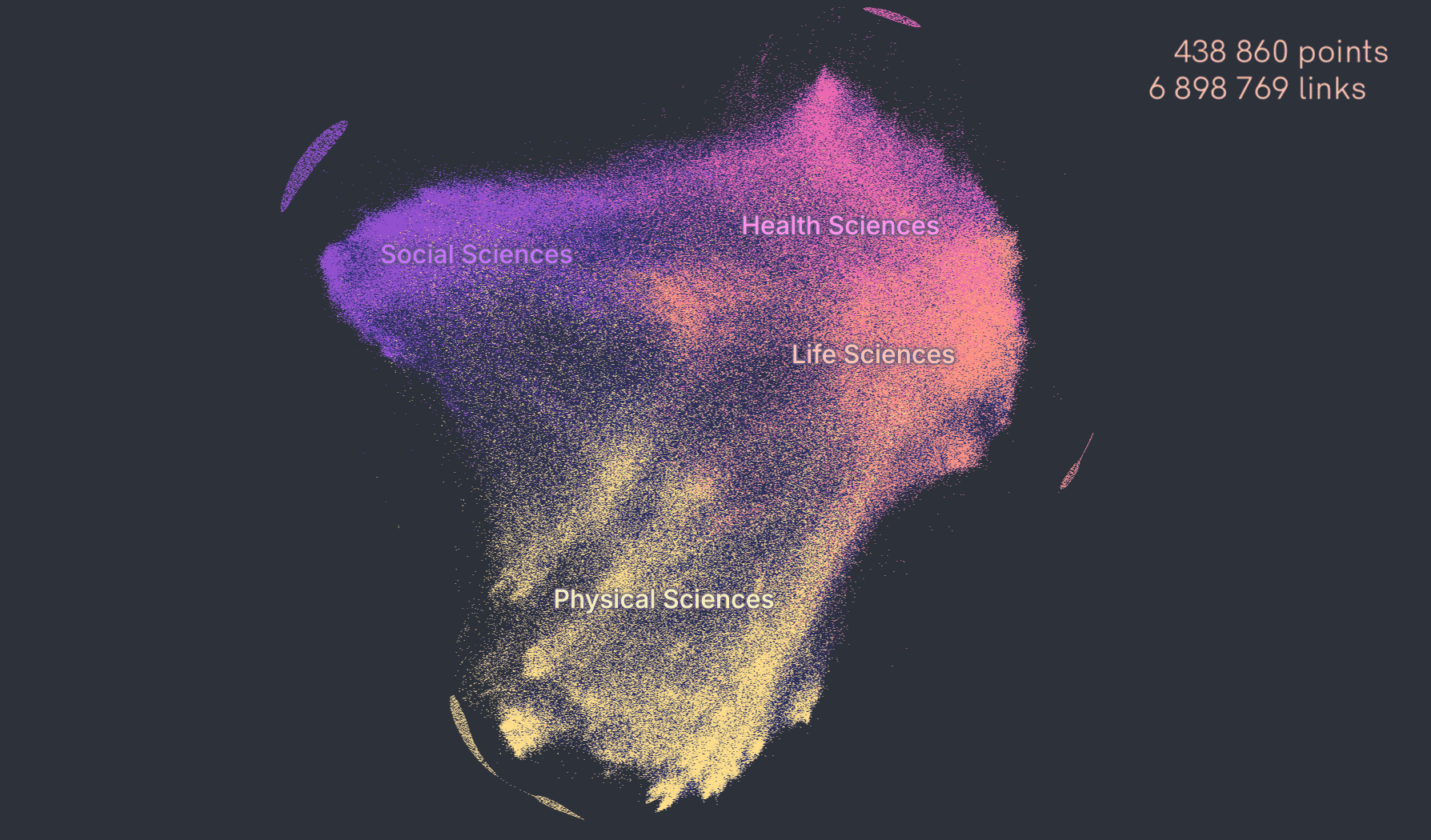

Make sense of your

graph|data

Visualize and analyze large network graphs and machine learning embeddings on your own device, no servers needed.

Showcase

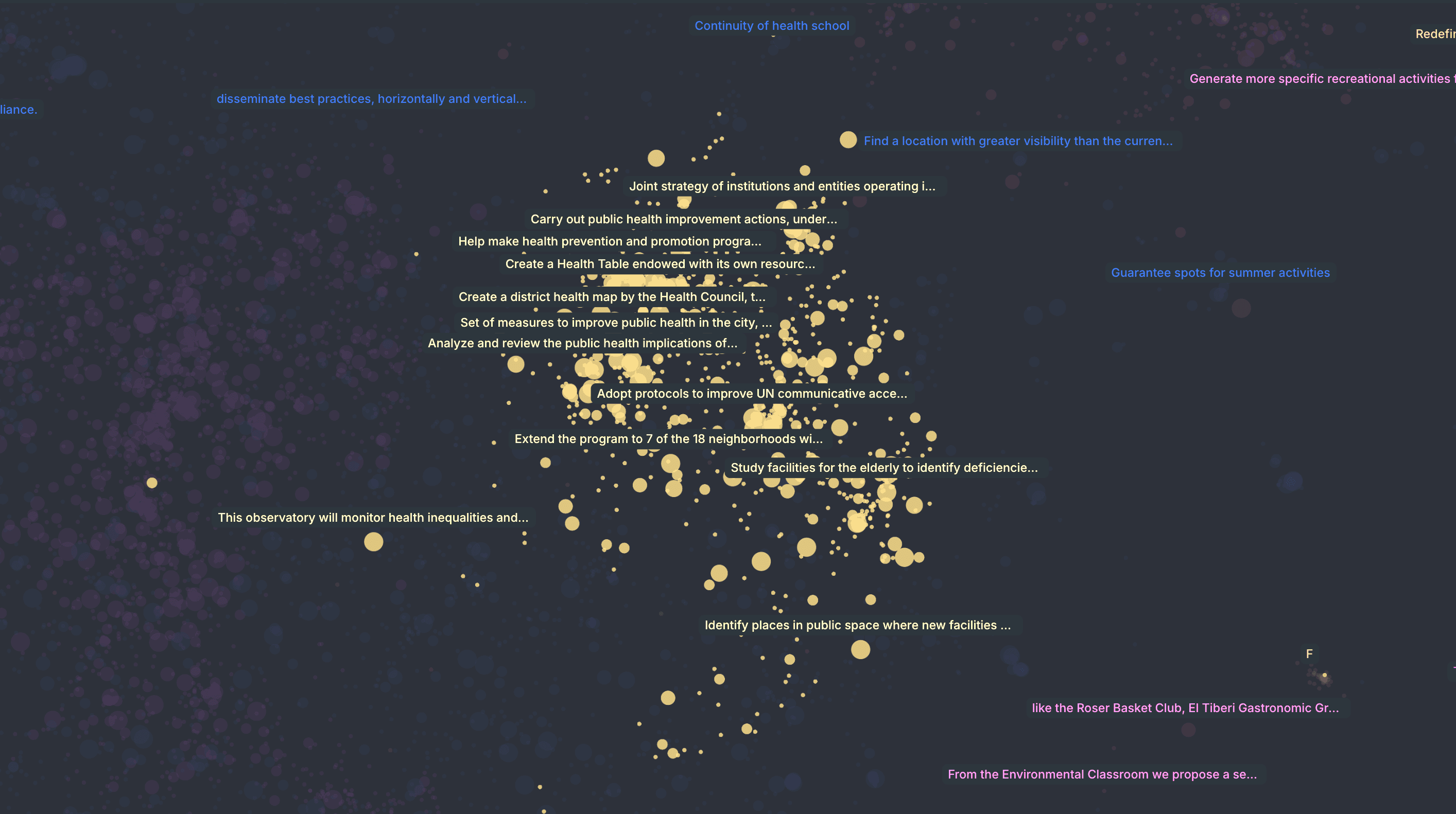

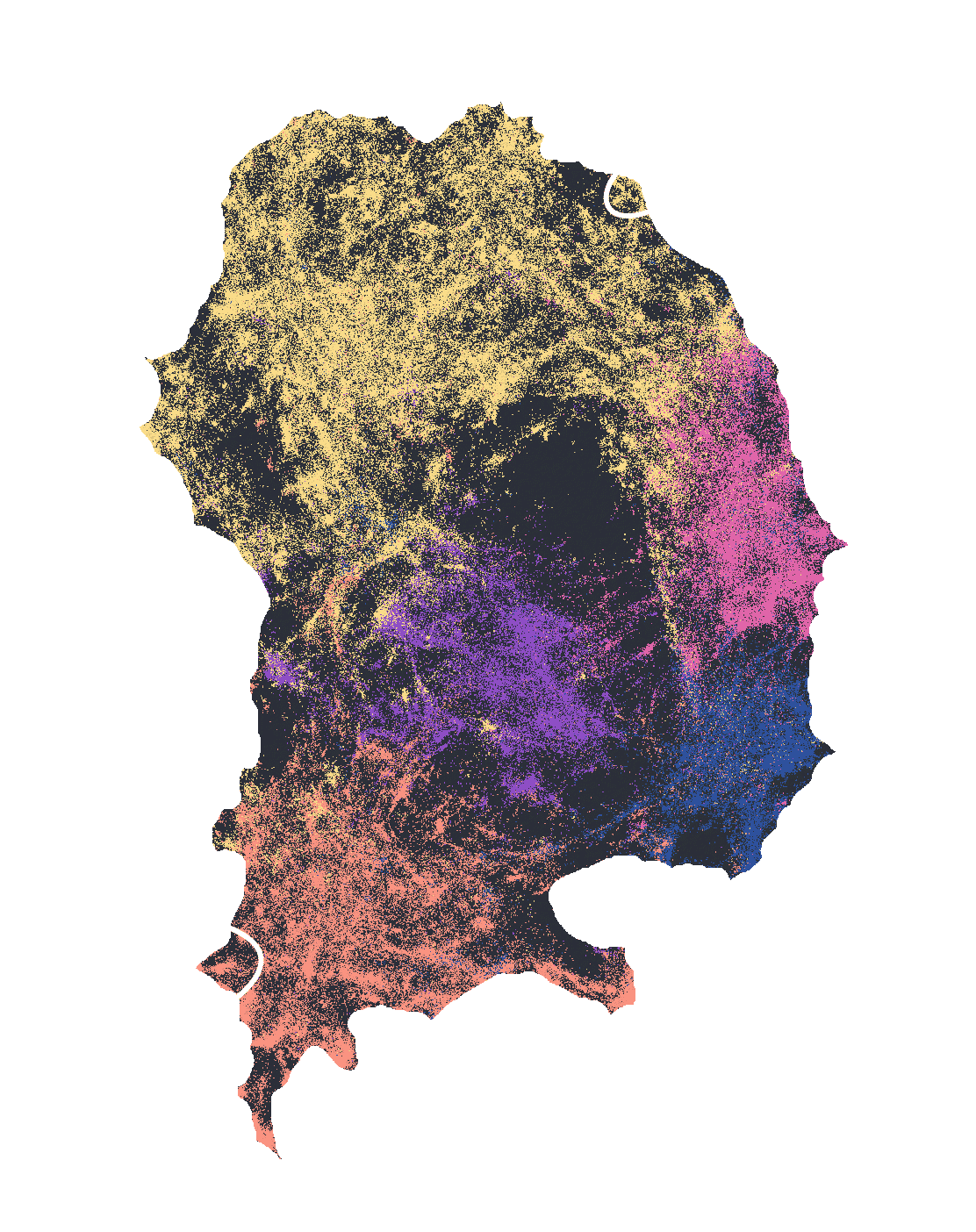

Barcelona City Proposals

Visualizing the most recurrent topics in more than 30K citizen proposals submitted to the participatory platform decidim.barcelona over an eight-year period. Created by Diego Arredondo.

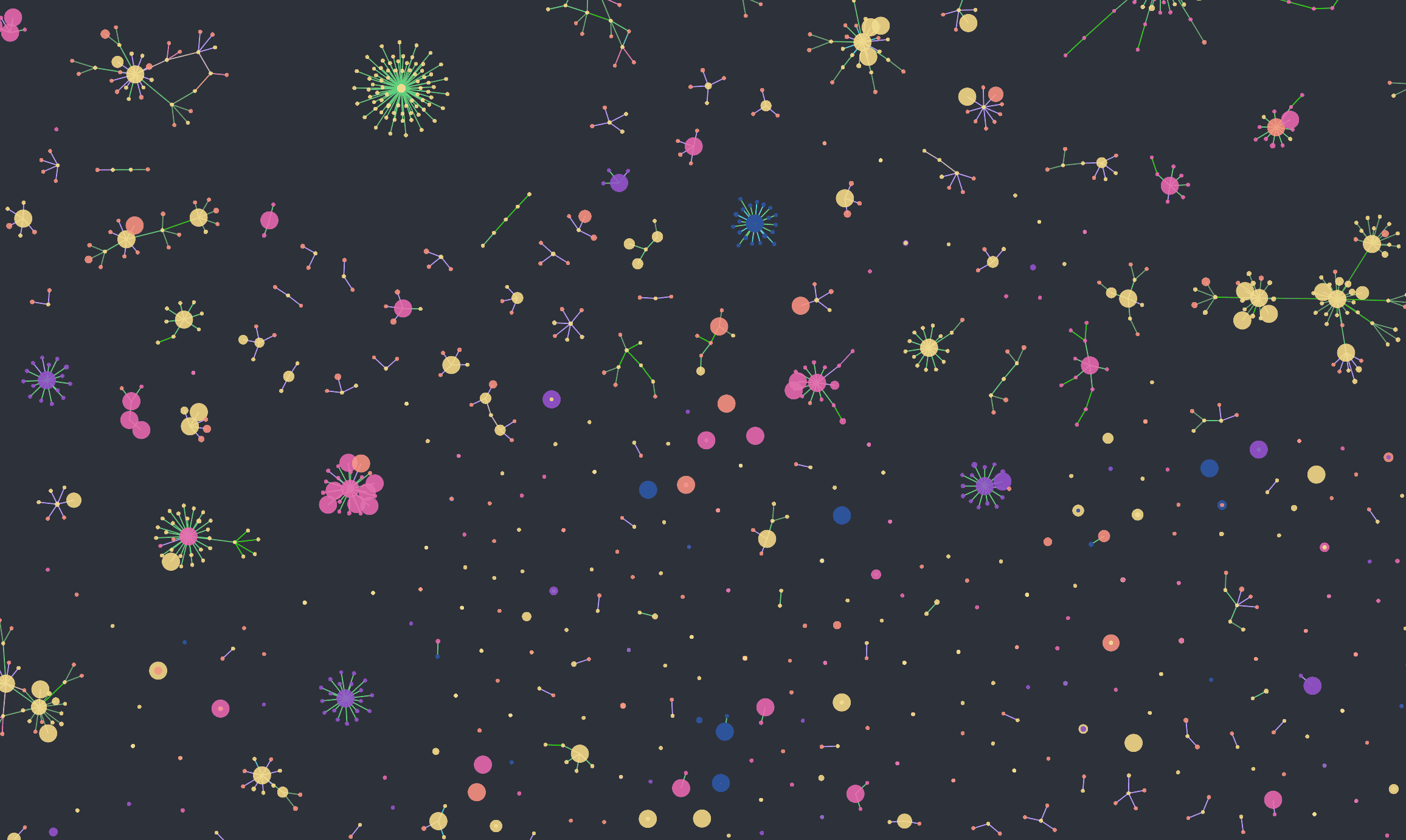

AI Model Atlas

Model Atlas visualizes entire populations of machine-learning models as an interconnected graph, showing how models evolve, relate, and transform through fine-tuning. Learn more at horwitz.ai/model-atlas.

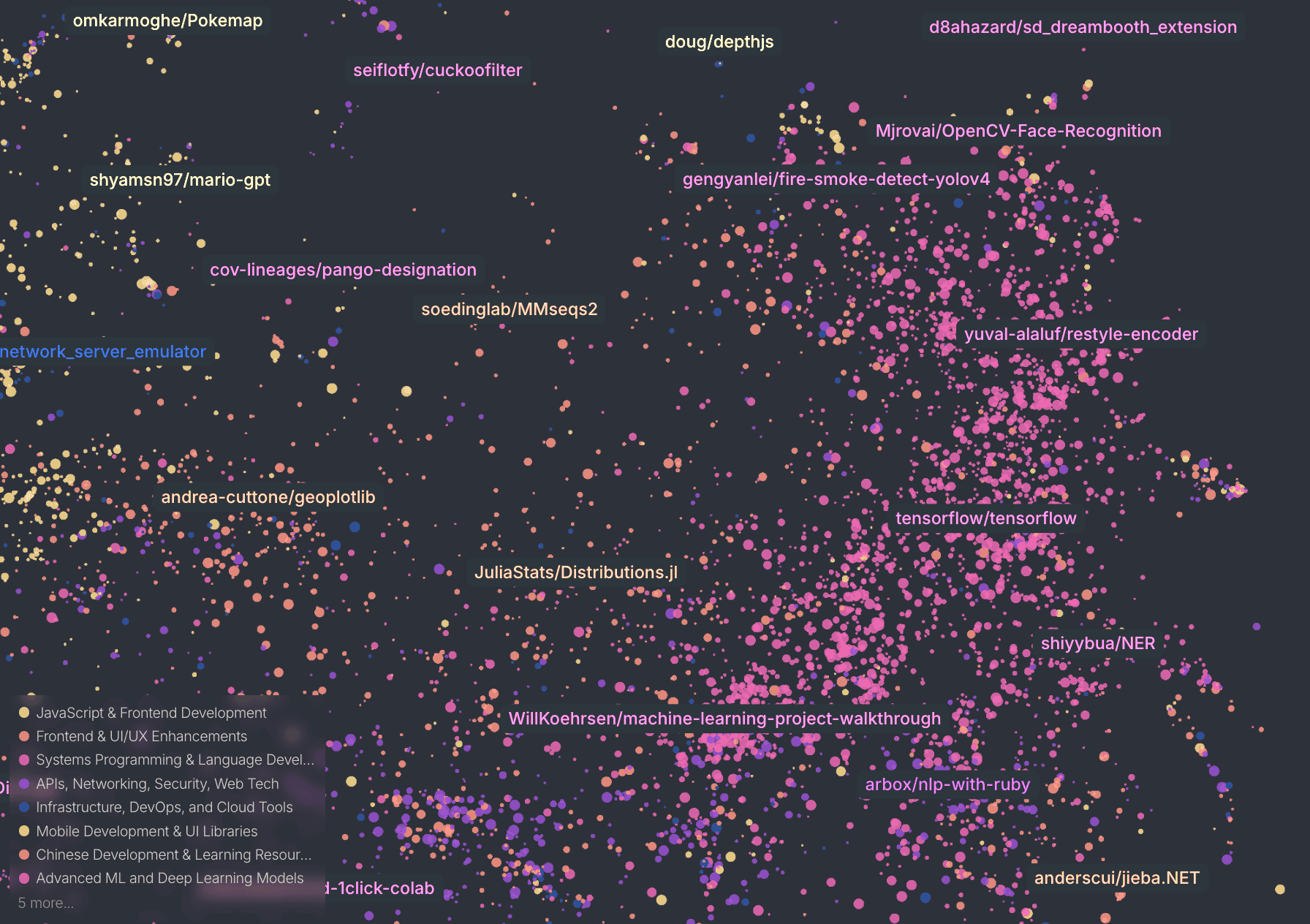

Map of GitHub

Semantic map of GitHub repositories. Each point represents a repository positioned by repo description.

Why people love Cosmograph

The fastest single-node graph analytics toolkit

The fastest web-based force network graph layout and rendering. Working with massive datasets. Built on top of DuckDB (the fastest in-memory analytics database).

Privacy-first

Your data stays local unless you decide to share it

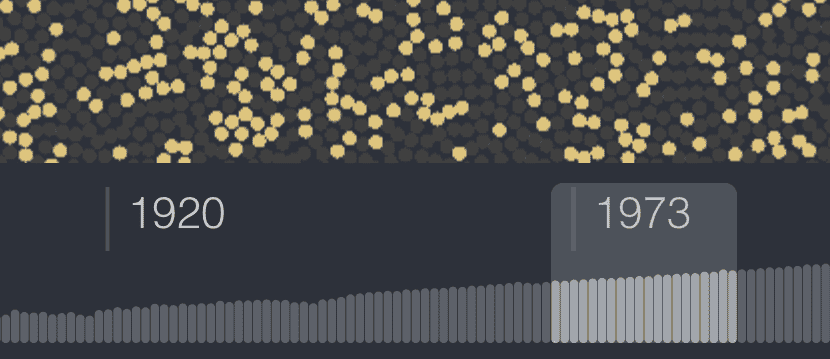

Time dimension

See you dataset evolving over time with the help of the Timeline

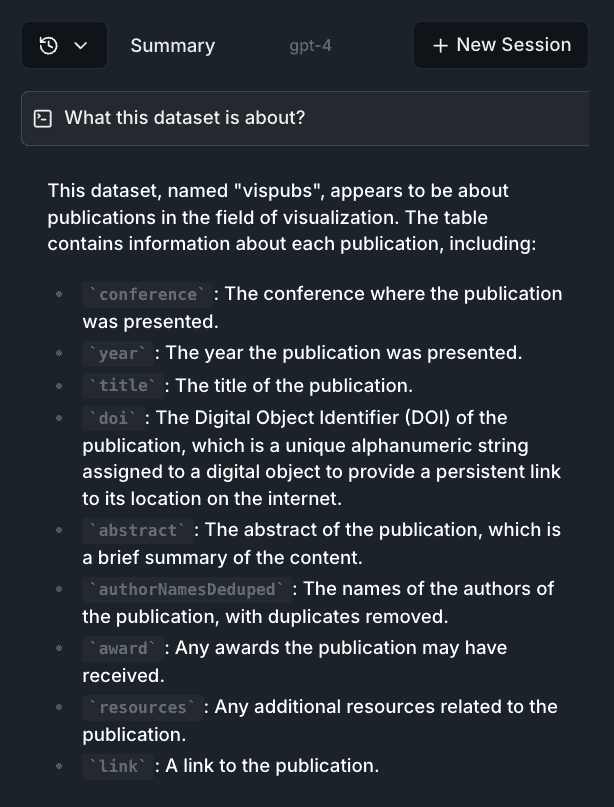

Chat with your dataclosed beta

Ask AI questions about your data and get answers in real-time

Graph sharing

Easily share your graph with colleagues or integrate it directly into your website.

By data analysts, for data analysts

Start in Python notebook, continue in the browser, build your web app with our library!

Collaborationclosed beta

Work with your team on the same graph

Powerful filtering & search

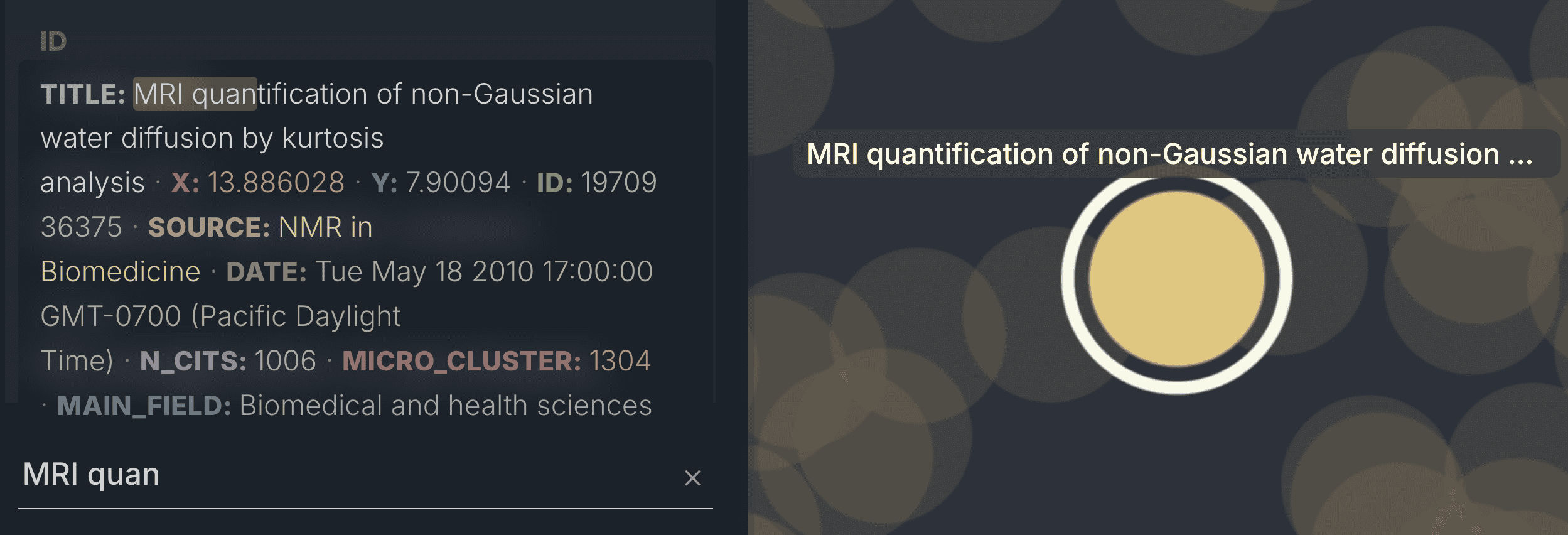

Filter your data through histograms, strip away noise, and spot the needle in the haystack: distributions, outliers, patterns.

Trusted by top researchers and engineers

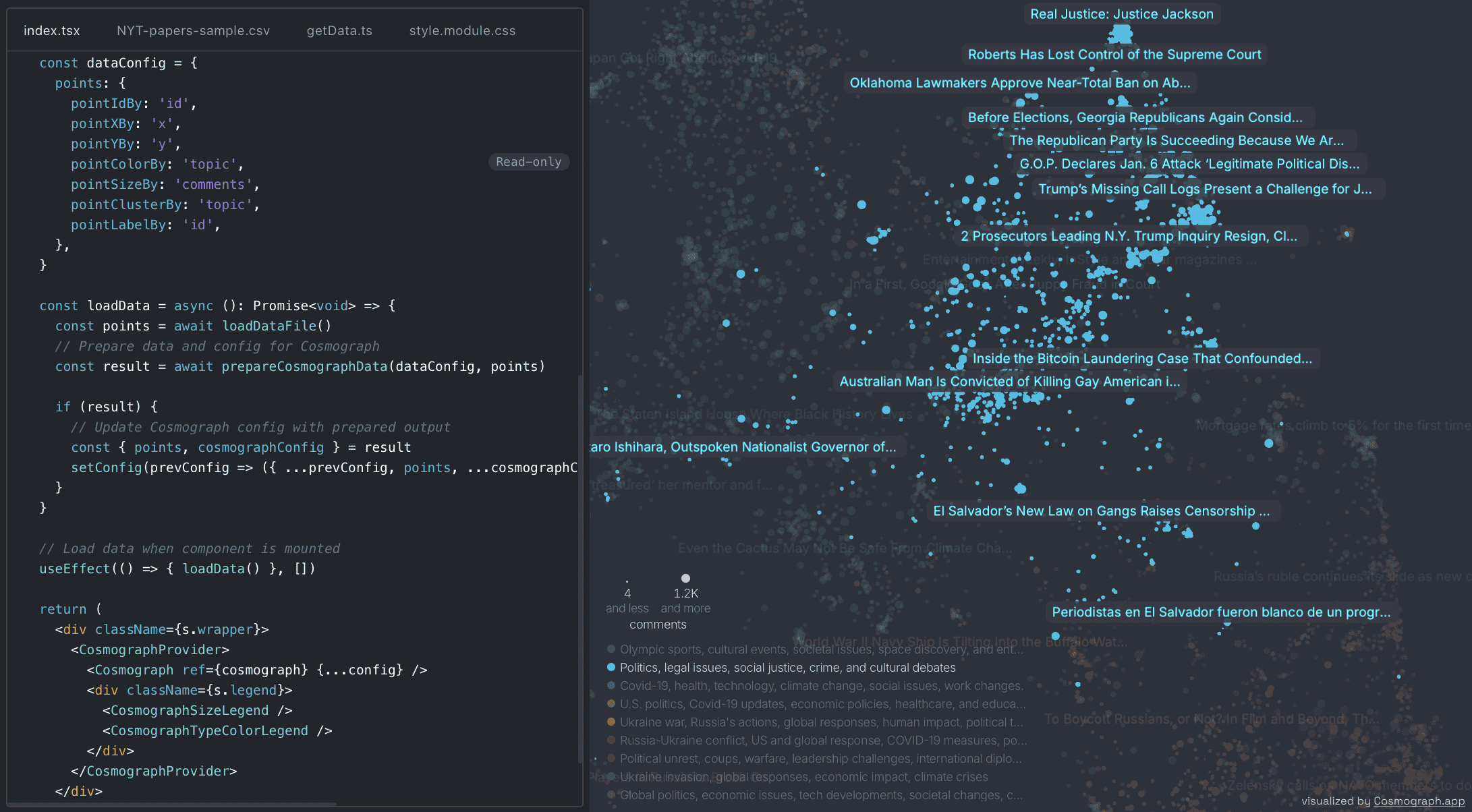

Web developer?

Try Cosmograph library!

Want to add Cosmograph capabilities into your own project?

Check out our React and TypeScript library.

Subscribe to updates

Subscribe to be the first to learn about new updates, features and discounts

Read the docs

Read the docs Try examples

Try examples